Skip to content

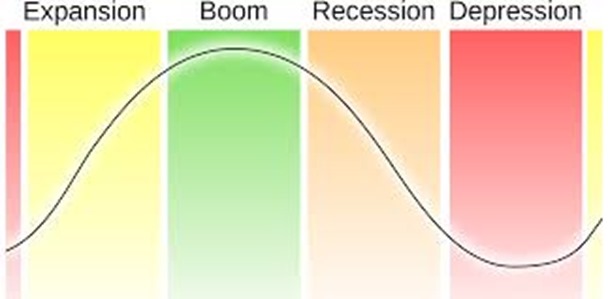

ffwbank capital ratios, bankruptcies, business cycle, central banking, COVID-19, debt-to-GDP ratios, fed funds rate, Federal Reserve, fiscal stimulus, FOMC, furloughs, GDP, Great Depression, helicopter money, home building, home equity extraction, inflation, mortgage debt, NBER, pandemic, recessions, spending power, unemployment, zombie companies

Read More

ffw6-cycle forecast, animal spirits, bank credit, behavioral economics, Big-3 recession precursors, business cycle, circular flow, credit conditions, Fed, fiscal policy, house prices, housing sector, Keynesians, lending standards, mainstream economics, monetary policy, public policies, recession, spending capacity, stock prices, TSP

Read More

ffwasset price cycles, bank credit, business cycle, business earnings, checklists, coincident indicators, component cycles, CPI, credit cycles, econometrics, economic forecasting, fiscal policy, foreign sector, GDP, home building cycle, household earnings, lagging indicators, leading indicators, monetary policy, recessions, S&P 500, six-cycle map, thin-air spending power, vicious loops, virtuous loops, yield curve

Read More

ffwasset price cycles, business cycle, checklists, component cycles, credit cycles, econometrics, economic forecasting, financial economy, fiscal policy, foreign sector, home building cycle, monetary policy, real economy, recessions, six-cycle map, vicious loops, virtuous loops

Read More

ffwBen Bernanke, credit growth, Federal Reserve, FOMC, Janet Yellen, monetary policy, net lending, QE1, QE2, QE3, quantitative easing, quantitative tightening, Z.1

Read More

ffwasset holding gains, bank credit, business cycle, circular flow, Federal Reserve, financial deflation, financial inflation, flow of funds, FOMC, Hyman Minsky, municipal bonds, recessions, reserve requirements, thin-air spending power, Treasury bonds, TSP, William McChesney Martin

Read More

ffwbank credit, business cycles, business-cycle indicators, Case-Shiller, expansions, final domestic demand, financial deflation, financial economy, financial inflation, recessions, S&P, thin-air spending power, yield curve

Read More

ffwbalance sheets, bank credit, business cycle, business-cycle indicators, economic theory, expansions, Federal Reserve, financial cycles, financial deflation, financial economy, financial inflation, flow of funds, holding gains, real economy, recessions, thin-air spending power, wealth effects

Read More